Core aims

- to provide professional support to one another in developing risk management techniques and frameworks, especially outside traditional actuarial areas

- to enable benchmarking of practices in relation to risk management

- to provide a discussion forum in relation to industry and regulatory issues

- to create networking opportunities for actuaries who hold CRO or very senior risk management roles within their companies

Meeting dates and topic plan: 2022/2023

- Thursday 29 September: 08.30 – 09.45

- Thursday 24 November: 08.15 – 09.45

- Thursday 23 February: 08.15 – 09.45

- Thursday 11 May: 08.15 – 09.45

- Thursday 06 July: 08.15 – 09.45

View the 2022-2023 topic plan >

What makes this group distinct from other CRO forums

The non-commercial nature of the group makes it distinct from other CRO groups and members have common challenges which can be discussed in a safe Chatham House Rules environment.

Want to join the group?

Contact Dawn McIntosh providing details of your role and ARN.

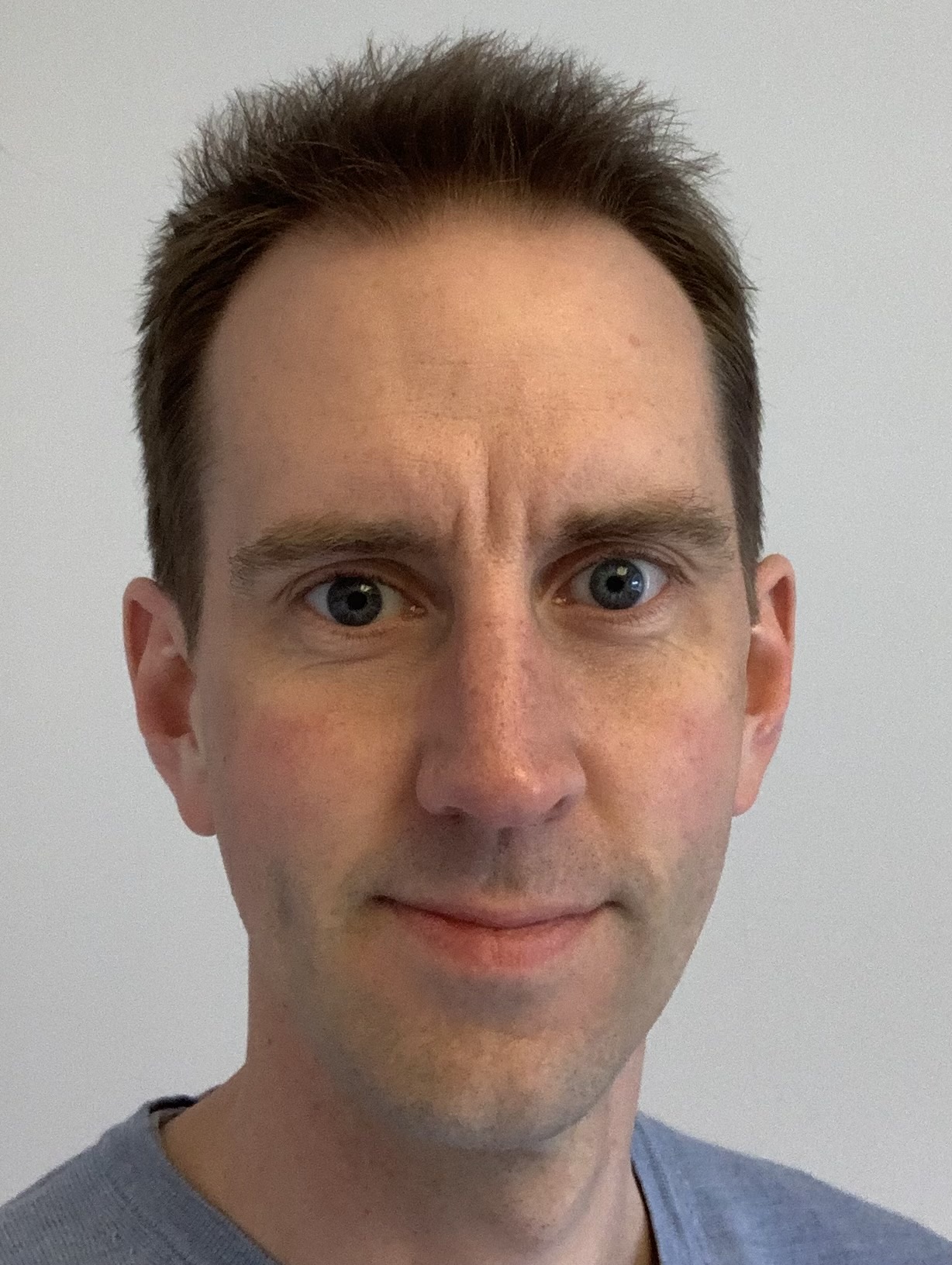

Meet the Chair

Russell Gill is Chief Risk Officer of a start-up bank called Perenna, which is applying for its banking license so it can change the mortgage market. His current role covers all financial risks, non-financial risks, and ESG.

Russell has diverse first and second-line risk experience gained from senior roles in financial services firms across a number of industries. He qualified as an actuary in 2009. He is also a qualified snowboarding instructor, but finds himself on snow much less often these days, given his important parental commitments (four young children).

The Actuarial CRO Group is a great platform for sharing knowledge and challenging perspectives with other senior risk professionals working in financial services. I have found it very rewarding and it has also provided valuable networking opportunities. The Actuarial CRO Group operates under Chatham House rules.

Meet the Deputy Chair

Wade Butlion is Head of Risk Management at RGA Reinsurance Company of South Africa. He is a qualified actuary with extensive experience in risk management and is responsible for all aspects of enterprise risk management across the company. He also holds the Financial Risk Management designation from the Global Association of Risk Professionals and is an Associate Member of the Institute of Risk Management South Africa.

The Actuarial CRO Group is a platform to share ideas and learn from other senior actuaries working in the risk management space. The nature of the group facilitates robust discussion and debate on topical issues in the risk management and wider business arenas. The group offers professional support from a diverse range of views and is a great way to benchmark practices and network with like-minded peers.

Read our case studies to find our more about CRO roles>

Contact Details

If you have any questions about a practice area, its working parties, Member Interest Groups or Board and sub-committees, please contact the Communities Team:

Events calendar

No results found.

The Actuarial CRO Group is a great platform for sharing knowledge and challenging perspectives with other senior risk professionals working in financial services. I have found it very rewarding and it has also provided valuable networking opportunities. The Actuarial CRO Group operates under Chatham House rules.

The Actuarial CRO Group is a great platform for sharing knowledge and challenging perspectives with other senior risk professionals working in financial services. I have found it very rewarding and it has also provided valuable networking opportunities. The Actuarial CRO Group operates under Chatham House rules. The Actuarial CRO Group is a platform to share ideas and learn from other senior actuaries working in the risk management space. The nature of the group facilitates robust discussion and debate on topical issues in the risk management and wider business arenas. The group offers professional support from a diverse range of views and is a great way to benchmark practices and network with like-minded peers.

The Actuarial CRO Group is a platform to share ideas and learn from other senior actuaries working in the risk management space. The nature of the group facilitates robust discussion and debate on topical issues in the risk management and wider business arenas. The group offers professional support from a diverse range of views and is a great way to benchmark practices and network with like-minded peers.