Research Team Biographies

|

|

Professor Jens Perch Nielsen, joint principal investigator for this programme and Professor of Actuarial Science at Cass Business School, London, with a PhD in statistics from UC-Berkeley. He is a fully qualified actuary from Copenhagen, an associate member of the IFoA and has twenty years of experience in the insurance and pension industry. The invention of Time Pension, when he was research director in the global insurer RSA, was a game breaker in the Danish market. He served six year as consultant and entrepreneur before joining Cass as a full professor in 2012. He is the co-author of more than 100 scientific papers in reviewed journals of actuarial science, economics, econometrics, operational research and statistics and also has co-authored a book on quantitative operational risk modelling. Professor Nielsen has co-written published academic papers with all academic members of the project. He will be the primary supervisor for the Cass Business School-located doctoral students and postdoctoral researcher. He will meet regularly with the industrial partner, Jens Lind (Danika Pension) to discuss the research results obtained to date and get their input and feedback. |

|

Dr Catherine Donnelly, joint principal investigator for this programme and Associate Professor, Department of Actuarial Mathematics and Statistics, School of Mathematical and Computer Sciences, Heriot-Watt University. Dr Donnelly is a qualified actuary and has worked for four years in the pensions industry. She has a PhD in mathematical finance from the University of Waterloo, Canada. Her research interests lie in pensions, life insurance and stochastic control theory, and she has been published widely in these areas. She has published several papers with Professor Nielsen and Professor Guillen, and has a close working relationship with both of them. Dr Donnelly is the principal investigator at Heriot-Watt University. She will be the primary supervisor for the Heriot-Watt-located doctoral student and postdoctoral researchers. |

|

Professor Montserrat Guillen, Director of the Riskcenter, the research group on Risk in Insurance and Finance, Institute of Applied Economics, University of Barcelona, Spain. Since April 2001, Professor Guillen has been Chair Professor of the Department of Econometrics at the University of Barcelona. Her research focuses on actuarial statistics, economics and quantitative risk management. She was President of the European Group of Risk and Insurance Economists, the Geneva Association, in 2011. She has served on industry boards as well as scientific groups, international programs and steering committees and she has also conducted R&D joint programmes with many companies. For example, she helped Professor Nielsen to invent Time Pension at the beginning of this millenium. Professor Guillen is expected to co-author at least ten of the fundamental papers of this programme. She is a popular invited conference speaker and will be a key player in the programme, when distributing our academic knowledge. |

|

Dr Ana M. Perez, Associate Professor of Actuarial Statistics at the University of Barcelona and a member of the research group Riskcenter. Her research interests are related to actuarial statistics, survival analysis and marketing in insurance. Dr Perez-Marin will take the computational lead of at least six papers of this project. She will provide one-to-one computational teaching to many of the doctoral students involved in the project. |

|

Professor Stefan Sperlich, Professor at the University of Geneva, Switzerland. He has published over 60 papers since 1994, in addition to six books. His research is on the analysis of econometric models,empirical economics, non- and semi-parametric methods and computational statistics. He has led many research projects, as well as several consulting projects for the Spanish government. Professor Sperlich will work with Dr Scholz on generating the outputs for Workstream 4. Professor Sperlich has the responsibility for producing the outputs. |

|

Dr Michael Scholz, Assistant Professor in the Department of Economics, University of Graz, Austria. His research interests are in economics and statistics, including semiparametric methods. Dr Scholz will work with Professor Sperlich on generating the outputs for Workstream 4. He will take the computational lead on these papers providing one-to-one teaching to the doctoral students involved. |

|

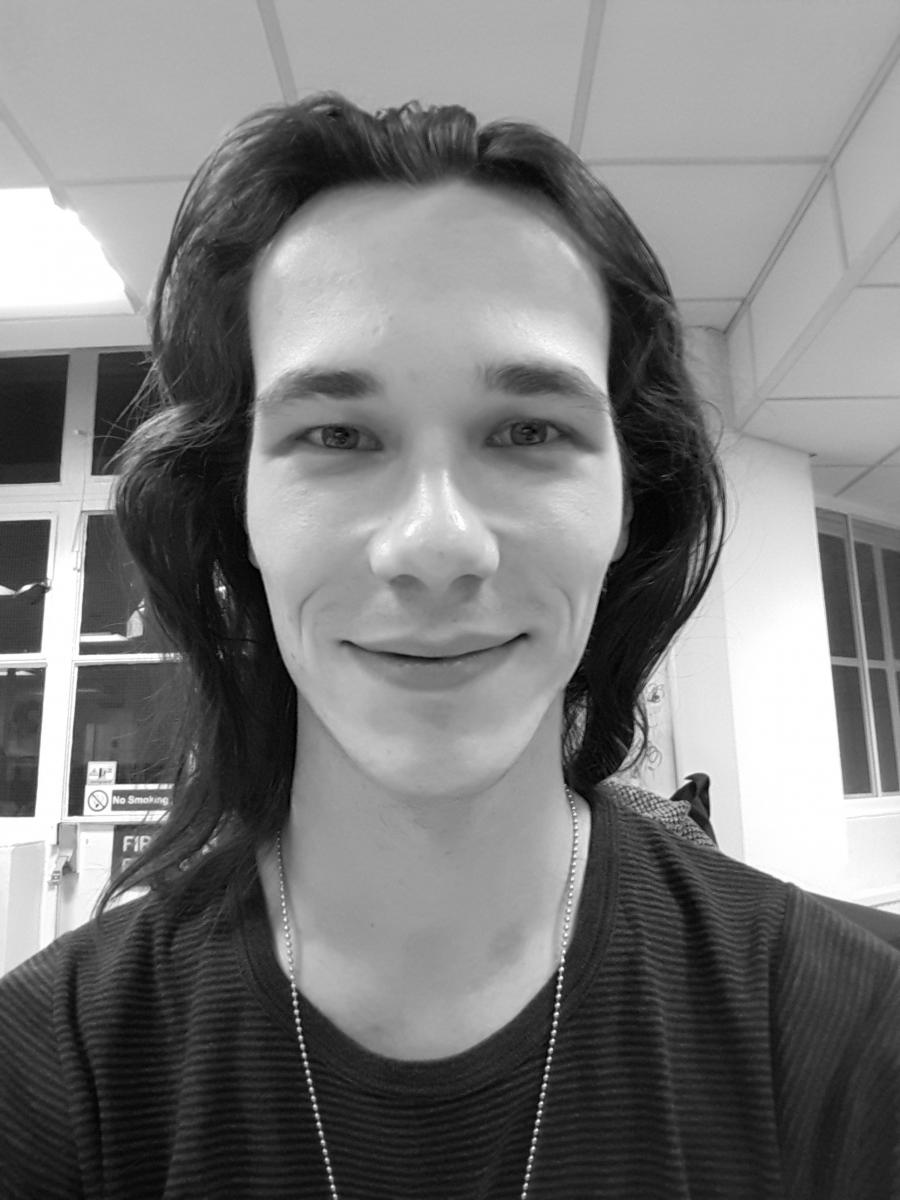

Dr Munir Hiabu, is a postdoctoral researcher on this research programme. Before joining the team, Munir studied Mathematics at Heidelberg University and obtained a PhD in Actuarial Science from Cass Business School. |

|

Dr Thomas Bernhardt, is a postdoctoral research on this research programme. Before joining the team he earned his PhD in mathematics from the London School of Economics and Political Science and moved to the UK from Berlin, Germany. He is passionate about mathematics and society, so joining a project to optimise future pension plans was a natural fit. |

|

Dr Rami Chehab, is a postdoctoral researcher on this programme. Before joining the team, Dr Chehab received his PhD in Econometrics from the University of Exeter in 2017. He also holds an MSc Economics and Econometrics from the University of Exeter and a BE in Mechanical Engineering with a minor in Mathematics and Economics from the American University of Beirut. Dr Chehab's research interest include the development of robust econometric and statistical inference methods using bootstrap algorithms with financial time-series: heavy-tails and dependent time series. These characteristics of financial time-series are a well-observed phenomenon, especially in our contemporary world. His research interest also includes modelling long-run asset returns for assessing risk and return for long-term investors such as pension plan participants. |

|

Peter Vodicka, is a PhD student working on this programme. Before joining the team Peter graduated from Comenius University in Bratislava where he studied Applied Mathematics and Modelling, before studying for his masters at Charles University in Prague. He is interested in subjects such as stochastic calculus, survival analysis, counting processes, portfolio risk management and optimal control. |

Events calendar

No results found.