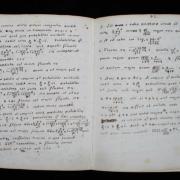

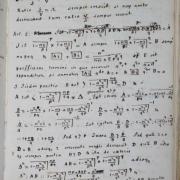

In 1763 Richard Price published ‘An essay towards solving a problem in the Doctrine of Chances [by] the late Rev. Bayes, F.R.S., communicated by Mr Price…’ in Philosophical Transactions [of the Royal Society] 53, pages 370-418. The essay, which Price claimed to have derived from papers he had found written by his late friend gave, rise to the significant branch of ‘Bayesian statistics’ though there has been debate about whether Bayes was the originator of the work. The notebook has been the subject of examination and published research and it contains a section on ‘probabilitas’ (sections 81-82) among other observations on astronomy and other mathematical topics.

As A.I. Dale concludes, ‘while this [the notebook] does not prove that “Bayes’s Theorem” is the discovery of our reverend friend [Thomas Bayes], it certainly indicates that the result was known to him some time before his death in 1761’.

As original work on probability theory, it is fitting that the notebook joins other leading texts on probability and other component works of 'actuarial analysis’ (demographic mortality data and calculations of compound interest) in the actuarial profession’s special library collections on actuarial science from the sixteenth century.

Interested readers can refer to papers below:

- Holland, J.D. (1962). The Reverend Thomas Bayes FRS (1702-1761). Journal of the Royal Statistical Society, Series A 125: 451-461.

- Dale, A.I. (1986). A newly discovered result of Thomas Bayes, Archive for History of Exact Sciences 35: 101-113.

- Bellhouse, D.R. (2002). On some recently discovered manuscripts of Thomas Bayes. Historia Mathematica 29: 383-394.

- Bellhouse, D.R. (2004). The Reverend Thomas Bayes, FRS: a biography to celebrate the tercentenary of his birth. Statistical Society 19(1): 3-43.

Related documents

-

Equitable Life Assurance Society (ELAS) Archive 1762 - 1975 at Institute of Actuaries Library, London

30 September 2007 -

Equitable Life (ELAS) archive. Catalogue of launch display, 3 April 2007

2 April 2007 -

The Bayesian controversy in statistical inference

27 February 1967 -

Books, manuscripts and documents dating before 1901 in the libraries of the Institute and Faculty of Actuaries

30 April 2020

Contact Details

For any library enquiries please contact:

We try to respond to email queries within one working day. Researcher access to historical resources may require notice in advance of visit in order to retrieve items from storage.

Events calendar

No results found.